Nhật Hoài

Active Member

- 9,576

- 59,533

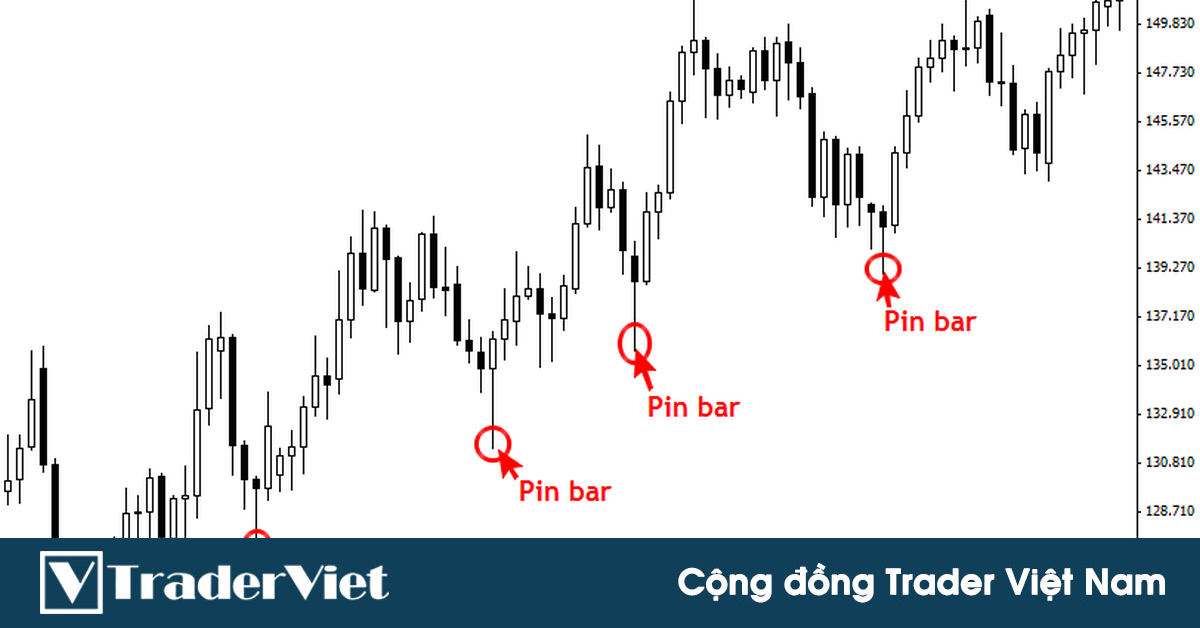

Khi nhắc đến các Setup Price Action người ta hay nghĩ tới “ pin bar”, “ inside bar”, “ fakey”, “nến nhấn chìm”, hay còn gọi là các Setup Price Action trong 1-2 thanh nến. Nhưng đó chỉ là những Setup price action dành cho những trader mới tập tành học về Price Action.

Bài này sẽ là 5 Setup price action dành cho các Pro Trader - những tay chơi chuyên nghiệp. Và mình đảm bảo là các Setup này hiệu quả hơn nhiều những pin bar hay fakey anh em thường nghe.

Anh em muốn được tag vào các bài chuyên về Price Action của Hoài thì ĐỂ LẠI COMMENT “TÔI QUAN TÂM” nhé. Bài này được chia làm 2 phần nên cũng ĐỂ LẠI COMMENT để được tag vào phần sau nhé.

Phá vỡ giả là 1 Setup price action giúp anh em có thể mua đáy và bán đỉnh với xác suất cao:

Phá vỡ giả xuất hiện khi giá phá vỡ qua 1 mức kháng cự (hoặc đỉnh) sau đó đảo chiều giảm theo hướng ngược lại. Tương tự khi giá phá vỡ xuống dưới 1 mức hỗ trợ (hoặc đáy) rồi bật lên tăng theo hướng ngược lại.

Mô hình phá vỡ giả mạnh mẽ ở chỗ nó tận dụng được đến 2 lực thuận nhau để khiến giá di chuyển và kiếm lợi nhuận: với cú phá vỡ giả từ tăng sang giảm, thị trường sẽ bị đạp xuống bởi lực chốt lời của những buyer trước đó, cộng thêm lực giảm từ các buyer phá vỡ bị dừng lỗ khi giá giảm. Ngược lại với cú phá vỡ từ giảm sang tăng.

Cách giao dịch:

1- Tìm các thanh nến tăng mạnh đến kháng cự

2- Để cho giá phá vỡ đỉnh hoặc kháng cự rõ ràng (để cho các buyer nhảy vào buy cú break)

3- Đợi giá giảm 1 thanh lớn và sell ngay khi nến này đóng cửa.

Thực hiện ngược lại với hướng tăng.

Ví dụ:

Phá vỡ cấu trúc giúp anh em bắt được đầu 1 con sóng xu hướng mới.

Phá vỡ cấu trúc là tín hiệu xác nhận xu hướng cũ bị phá vỡ và hình thành xu hướng mới, nên sẽ rất lợi thế khi ta vào lệnh ngay đầu xu hướng mới.

Cách giao dịch:

1- Chờ 1 xu hướng tăng tiếp cận 1 vùng kháng cự rất mạnh trên khung thời gian lớn hơn.

2- Giá không thể tạo ra đỉnh cao hơn mà thay vào đó lại tạo 1 đỉnh thấp hơn (đây chính là điểm đặt dừng lỗ)

3- Sell khi swing low gần nhất bị phá xuống.

Ví dụ:

Mẹo: xu hướng tăng khi tiếp cận kháng cự thì các nến phải có thân ngắn dần lại, bóng nến dài ra hơn, và có thể phá vỡ đường ema 21 trước khi phá vỡ cấu trúc. Do đó khi có các dấu hiệu này thì nên chuẩn bị vào lệnh.

Breakout với cụm buildup là cách tốt nhất để giao dịch phá ngưỡng.

Giá tăng đến kháng cự và bắt đầu tích luỹ. Tuy nhiên giá không thể giảm mà liên tục bị “mắc kẹt” ngay bên dưới kháng cự. Đoạn tích luỹ đó được gọi là buildup. Ngay khi giá break lên buildup thì ta buy.

Ví dụ:

Mẹo: thị trường phải giao dịch đi ngang trong ít nhất 80 thanh nến, như vậy thì kháng cự mới đủ mạnh tạo sức bật cho cú break.

(CÒN TIẾP)

Bài này được chia làm 2 phần nên anh em ĐỂ LẠI COMMENT để được tag vào phần sau nhé.

Bài này sẽ là 5 Setup price action dành cho các Pro Trader - những tay chơi chuyên nghiệp. Và mình đảm bảo là các Setup này hiệu quả hơn nhiều những pin bar hay fakey anh em thường nghe.

Anh em muốn được tag vào các bài chuyên về Price Action của Hoài thì ĐỂ LẠI COMMENT “TÔI QUAN TÂM” nhé. Bài này được chia làm 2 phần nên cũng ĐỂ LẠI COMMENT để được tag vào phần sau nhé.

Setup Price Action - 1: Phá vỡ giả (false break)

Phá vỡ giả là 1 Setup price action giúp anh em có thể mua đáy và bán đỉnh với xác suất cao:

Phá vỡ giả xuất hiện khi giá phá vỡ qua 1 mức kháng cự (hoặc đỉnh) sau đó đảo chiều giảm theo hướng ngược lại. Tương tự khi giá phá vỡ xuống dưới 1 mức hỗ trợ (hoặc đáy) rồi bật lên tăng theo hướng ngược lại.

Mô hình phá vỡ giả mạnh mẽ ở chỗ nó tận dụng được đến 2 lực thuận nhau để khiến giá di chuyển và kiếm lợi nhuận: với cú phá vỡ giả từ tăng sang giảm, thị trường sẽ bị đạp xuống bởi lực chốt lời của những buyer trước đó, cộng thêm lực giảm từ các buyer phá vỡ bị dừng lỗ khi giá giảm. Ngược lại với cú phá vỡ từ giảm sang tăng.

Cách giao dịch:

1- Tìm các thanh nến tăng mạnh đến kháng cự

2- Để cho giá phá vỡ đỉnh hoặc kháng cự rõ ràng (để cho các buyer nhảy vào buy cú break)

3- Đợi giá giảm 1 thanh lớn và sell ngay khi nến này đóng cửa.

Thực hiện ngược lại với hướng tăng.

Ví dụ:

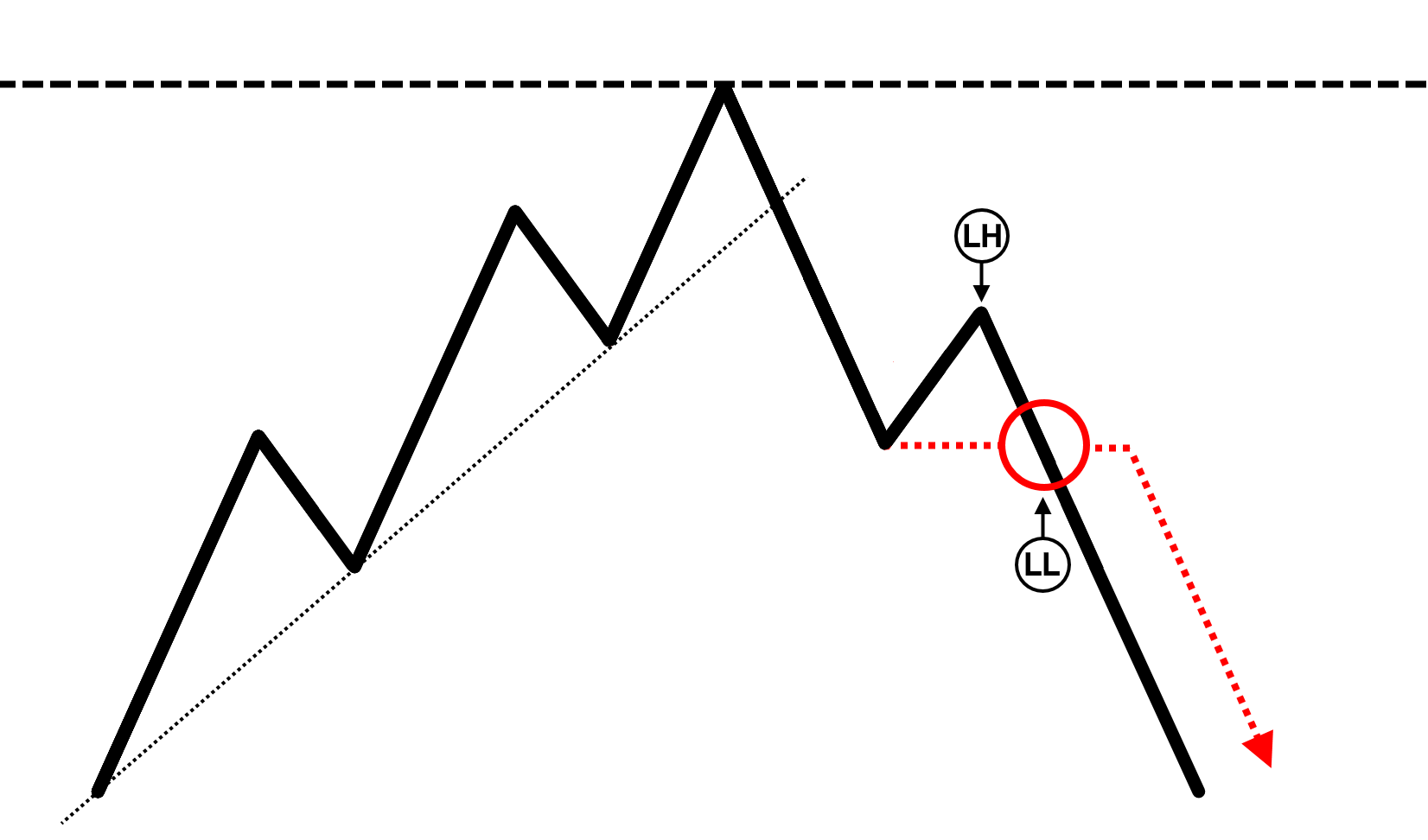

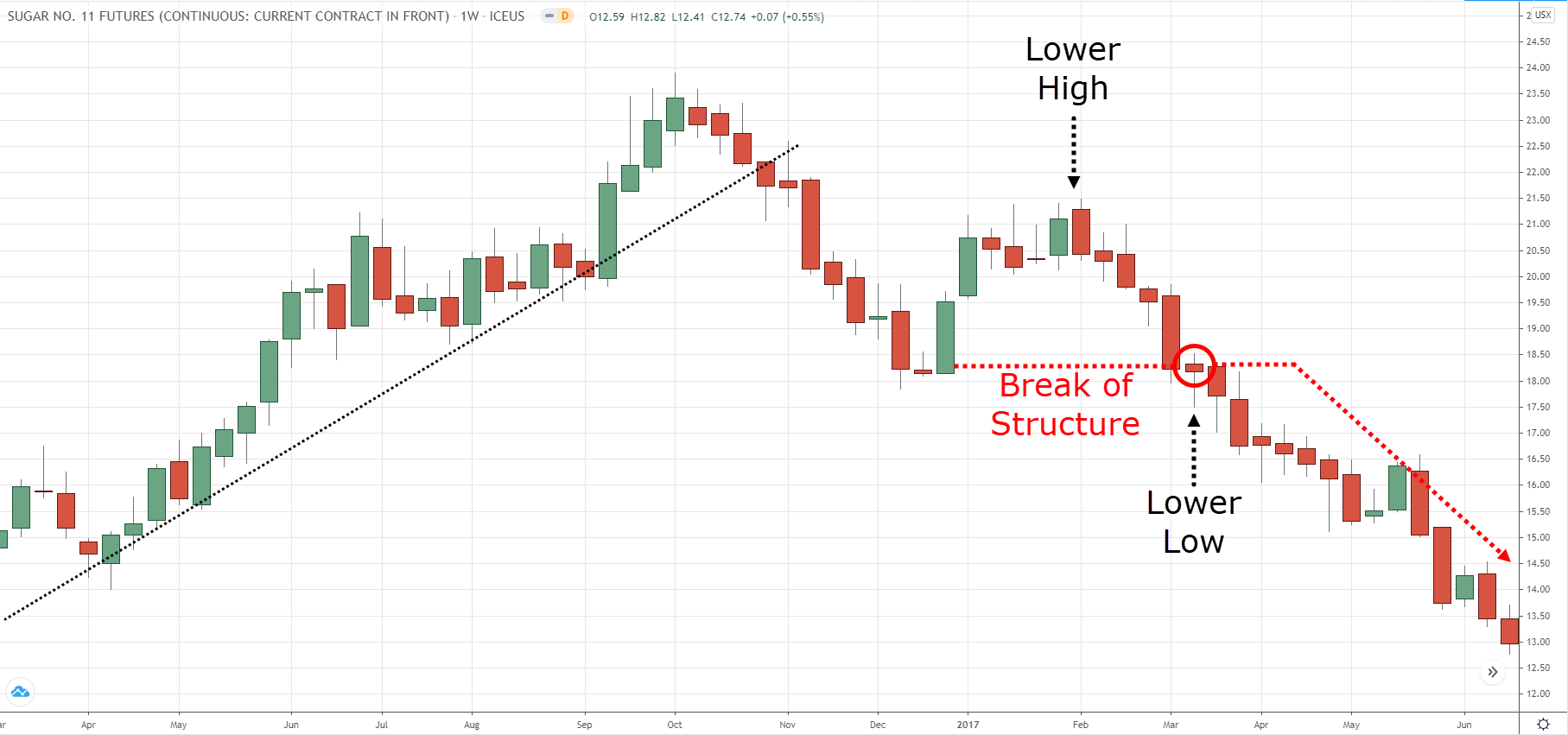

Setup Price Action - 2: Phá vỡ cấu trúc

Phá vỡ cấu trúc giúp anh em bắt được đầu 1 con sóng xu hướng mới.

Phá vỡ cấu trúc là tín hiệu xác nhận xu hướng cũ bị phá vỡ và hình thành xu hướng mới, nên sẽ rất lợi thế khi ta vào lệnh ngay đầu xu hướng mới.

Cách giao dịch:

1- Chờ 1 xu hướng tăng tiếp cận 1 vùng kháng cự rất mạnh trên khung thời gian lớn hơn.

2- Giá không thể tạo ra đỉnh cao hơn mà thay vào đó lại tạo 1 đỉnh thấp hơn (đây chính là điểm đặt dừng lỗ)

3- Sell khi swing low gần nhất bị phá xuống.

Ví dụ:

Mẹo: xu hướng tăng khi tiếp cận kháng cự thì các nến phải có thân ngắn dần lại, bóng nến dài ra hơn, và có thể phá vỡ đường ema 21 trước khi phá vỡ cấu trúc. Do đó khi có các dấu hiệu này thì nên chuẩn bị vào lệnh.

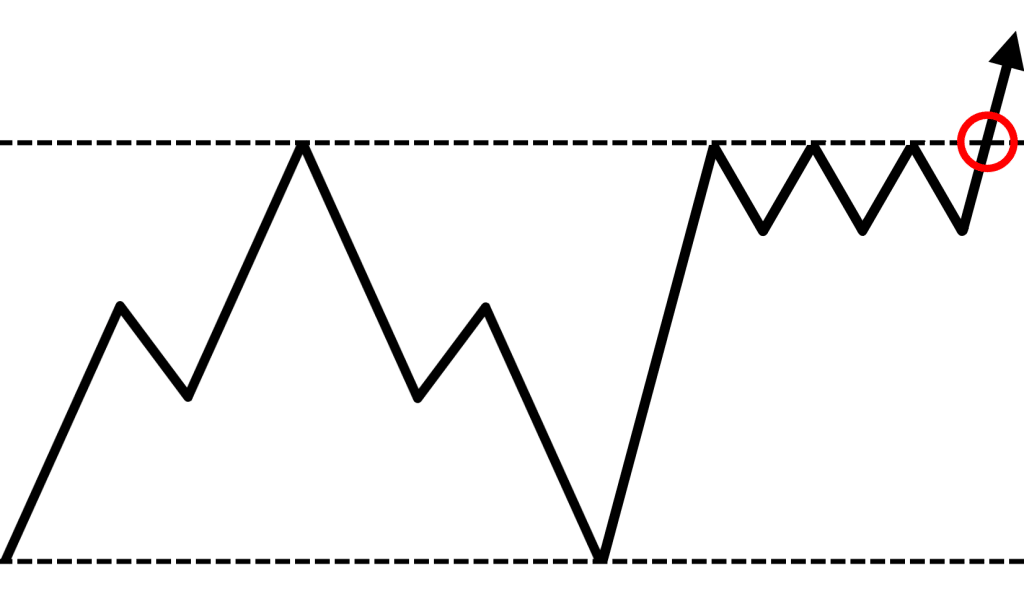

Setup Price Action - 3: Breakout với cụm buildup

Breakout với cụm buildup là cách tốt nhất để giao dịch phá ngưỡng.

Giá tăng đến kháng cự và bắt đầu tích luỹ. Tuy nhiên giá không thể giảm mà liên tục bị “mắc kẹt” ngay bên dưới kháng cự. Đoạn tích luỹ đó được gọi là buildup. Ngay khi giá break lên buildup thì ta buy.

Ví dụ:

Mẹo: thị trường phải giao dịch đi ngang trong ít nhất 80 thanh nến, như vậy thì kháng cự mới đủ mạnh tạo sức bật cho cú break.

(CÒN TIẾP)

Bài này được chia làm 2 phần nên anh em ĐỂ LẠI COMMENT để được tag vào phần sau nhé.

Nguồn TWR

Giới thiệu sách Trading hay

Các Phương Pháp Price Action Kinh Điển

Bộ sách tổng hợp các phương pháp Price Action truyền thống và hiện đại, với các hướng dẫn cụ thể và dễ áp dụng cho nhà giao dịch

Bài viết liên quan